HOTEL PERFORMANCE METRICS

RESEARCH OUTCOMES

T

To all those hoteliers out there with big opinions, we’d love your input to this piece of research the HSMAI Asia Pacific Revenue Advisory Board collaborated on with Dr. Detlev Remy from the Singapore Institute of Technology.

The research looked at the performance metrics hotels are currently using, then moved onto the metrics they would like to use in the future and what the roadblocks are for moving onto new metrics. This makes interesting reading, and you won’t be shocked that 77% of hotels are using RevPAR, you might be surprised by how many have a culture around Total Revenue Management.

Read on, and please join us for the next stage of this study by commenting using our Contact Us form.

The performance of revenue management has been traditionally measured with metrics, such as occupancy (OCC), average daily rate (ADR) and revenue per available room (RevPAR). These revenue management metrics utilised by the hospitality industry have been in existence since almost 30 years ago. Nevertheless, some hospitality businesses today have progressed to extended measures, such as gross profit per available room (GopPAR) and total revenue per available room (TRevPAR). As the world shrinks with globalisation and revenue management has evolved, there is an urgent need to revise the metric that the industry employs. In fact, practitioners have urged for new metrics to reflect more accurately the new development in revenue management. One example of such new metrics is the application of Total Revenue Management which includes other departments on top of rooms. Another example resulting from the shift towards Customer-centric Revenue Management is Revenue per available customer (RevPAC). Both metrics are under discussion but yet to conceptualise.

The Hospitality Sales & Marketing Association International (HSMAI) has commissioned Singapore Institute of Technology (SIT), represented by Assoc. Professor Dr. Detlev Remy, and a joint researcher team (Asst. Prof. Tan, SIT, Asst. Prof. Boo, SIT, Ms Shirley Tee, NYP, Mr. Stan Josephi, NHTV) to undertake a research on revenue management. The study aims to identify the different Revenue Management metrics in use, their limitations, and the possible new Revenue Management metrics.

Objective 1

Determine the use of existing Revenue Management metrics and their limitations.

Objective 2

Identify new Revenue Management metrics, the opportunities, limitations, and willingness of practitioners to adopt.

Objective 3

Investigate the willingness of Revenue Management suppliers/vendors to support the adoption of the new Revenue Management metrics.

The data collection was executed in three stages: focus group discussion, practitioner survey, and vendor survey. At the first stage, a focus group discussion was conducted with a group of senior management of the major hotel chains and integrated resorts, as well as members of the HSMAI APAC Revenue Advisory Board. The purpose of the focus group discussion was to identify the critical questions to be included in the subsequent survey questionnaire. Fifteen hospitality industry practitioners participated in the roundtable discussion held in Singapore on 24th April 2017. Three major topics emerged from the discussion included (a) the actual Revenue Management metrics used by the practitioners, (b) the criteria of new Revenue Management metrics, and (c) the challenges and impacts of new Revenue Management metrics.

The second step involved a data collection procedure via a Qualtrics online survey questionnaire. The survey was developed based on the findings in the focus group discussion. Twelve questions were constructed and the survey was sent out to the industry practitioners in June 2017 and lasted until March 2018, with in total of nine email blasts and reminders. The response rate is 27.2% (953 out of 3500).

The final stage was a survey aimed at 16 selected leading vendors and suppliers in the area of Revenue Management (i.e. Revenue Management software suppliers, travel data information providers etc.). The data was collected from April – June 2018 to ascertain the support and engagement with vendors and suppliers to revised Revenue Management metrics. The response rate is 43.8% (7 out of 16).

Stage 1 (May-June 2017) : Focus group with senior management of major hotel chains

Stage 2 (June 2017-March 2018) : Survey on industry practitioners

Stage 3 (April-June 2018) : Survey on selected RM vendors and suppliers

A couple of new Revenue Management metrics emerged during the discussion. The focus group participants strongly believe that the structure of organization departments and the departmental collaboration, such as in sales, should be redefined with the introduction of the new Revenue Management metrics. These metrics include:

- TRevPAR – Although RevPAR is pervasively used as a Revenue Management metric, it appears that TRevPAR is not clearly understood by the Hotel Owners or Assets Managers.

- Contribution per available space time (ConPAST) – This metric was introduced in association with function space.

- Revenue per available seat hour (RevPASH) – This Revenue Management metric is applicable to the restaurant industry which has been lagging in adopting the Revenue Management concept.

- RevPAC – this Revenue Management metric has not been discussed substantially since “available room” remains the focus of the industrial practitioners. However, RevPAC could be a potential powerful metric in the future.

- Net revenue per available room (NRevPAR) – This Revenue Management metric is the next logical extension of RevPAR by subtracting the marketing costs from revenue. This metric assesses the efficient deployment of marketing resources in revenue generation. Hence, the costs should include website costs, loyalty costs, and other marketing costs. It could also be analyzed according to market segments and channels.

However, the metric faces a few challenges before it could be widely adopted by the industry. First, many industrial practitioners have yet to provide such data. Second, there has not been a standardized approach to deduct marketing costs. Finally, the metric does not capture the total value of a customer, e.g. repeat business.

- Others

Besides total spend per customer, Revenue Management metrics related to customer segment were prevalently raised in the discussion. These metrics include spend/profit margin per segment, guest capture per segment, and cost per segment.

In summary, the suggested metrics focus greatly on the aspect of “results after costs”, especially from the owner’s perspective. The types of costs are concentrated on the marketing and distribution costs.

3.2.1. Industry Respondents Profile

The study targeted global individuals at the managerial level in the Hospitality Business sector. The top three functions of the respondents are Revenue Management (78.0%), Marketing and Sales (9.0%), and Operations (5.6%).

Figure 1. Respondents Profile

3.2.2. Type and Category of Hotel

Furthermore, the study asked the respondents to indicate the type and category of hotel. Specifically, the question helps to understand the different needs and requirements of hotels with respect to Revenue Management metrics.

Majority of the respondents are from hotel chain (81.4%) and independent properties (16.3%) with a breakdown of the property size as follow (see Figure 2).

Figure 2. Type and Category of Hotel

3.2.3. Average Size of Hotel

The study also asked the respondents to indicate the average size of the property, with the intention to see whether there are differences in Revenue Management application and use of metrics.

44.8% of respondents reported less than 200 rooms, 37.4% has room size between 201-400 rooms, 10.8% has room size between 401-600 rooms, and 7.1% has more than 600 rooms.

Figure 3. Average Size of Property

3.2.4. Primary Source of Revenue

Hotel revenue is typically generated from room sales, which may be divided into leisure and corporate. Other sources of revenue include function space, food and beverage, gaming, retail and spa. To resonate the urge to extend revenue management beyond room sales, the study asked the respondents to rank the primary sources of revenue for their property in the descending order (rank 1 = high, rank 7 = low).

Results of the descriptive analysis (see Table 1) show that room sales from the leisure and corporate segments constituted the first and second primary source of hotel revenue. Function space and food and beverage sales are the third and fourth important sources, respectively. Revenue generated from spa was ranked fifth, followed by retail. It is not surprising that gaming was rated the least important source.

Table 1. Primary Source of Revenue

| Source of Revenue | Ranking | ||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | |

| Rooms – Leisure

|

478

(49.3%)

|

296

(30.5%)

|

96

(9.9%)

|

58

(6.0%)

|

22

(2.3%)

|

11

(1.1%)

|

8

(0.8%)

|

| Rooms – Corporate

|

397 (41.0%)

|

356 (36.7%) | 84

(8.7) |

50 (5.2%) | 42

(4.3%) |

25

(2.6%) |

15

(1.5%) |

| Function Space

|

28

(2.9%) |

142

(14.7%)

|

408

(42.1%)

|

274

(28.3%)

|

71

(7.3%)

|

34

(3.5%)

|

9

(0.9%)

|

| Food and Beverage

|

15

(1.5%)

|

134

(13.8%)

|

291

(30.0%)

|

430

(44.4%)

|

70

(7.2%)

|

21

(2.2%)

|

4

(0.4%)

|

| Gaming | 21

(2.2%)

|

3

(0.3%)

|

6

(0.6%)

|

9

(0.9%)

|

97

(10.0%)

|

152

(15.7%)

|

666

(68.7%)

|

| Retail | 25

(2.6%)

|

29

(3.0%)

|

38

(3.9%)

|

65

(6.7%)

|

240

(24.8%) |

486

(50.2%)

|

74

(7.6%)

|

| Spa | 5

(0.5%)

|

9

(0.9%)

|

44

(4.5%)

|

78

(8.0%)

|

417

(43.0%)

|

227

(23.4%)

|

178

(18.4%)

|

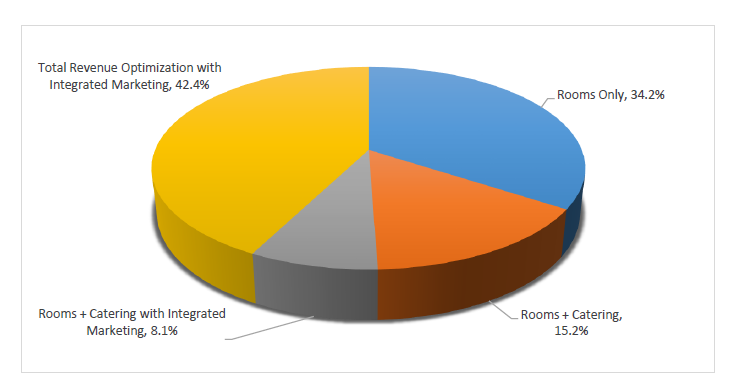

3.2.5. Revenue Management Culture

Respondents were also asked to specify their Revenue Management culture. The rationale for these four options was derived from the different levels of Revenue Management applications in the current hotel operations. From a more traditional room-centered approach to the inclusion of food and beverage, events and spas up to the level where cost of acquisition, such as marketing costs, the final stage of Revenue Management application is clearly a more holistic one. It focuses on the bottom line of the business by incorporating all revenue generated from the various departments and the marketing cots needed for customer acquisition.

Four options have been displayed:

Answer Option: Rooms focussed

Answer Option: Rooms + Catering focussed

Answer Option: Rooms + Catering with integrated marketing

Answer Option: Total Revenue Optimisation with integrated Marketing

The existing culture of revenue management appears to be at the two extremes (see Figure 4): total revenue optimization with integrated marketing (42.4%) and room focused (34.2%).

Hotel Revenue Management uses various metrics to show the effectiveness and efficiency of hotel to generate revenues (Mauri, 2012). The key hotel Revenue Management metrics are Occupancy (OCC), Average Daily Rate (ADR), and RevPAR (Revenue per available room). OCC essentially measures the utilization of the physical capacity of the hotel. ADR is the average price charged by the hotel for a room night. It is intuitive, straightforward, and easy to calculate and understand. Furthermore, it is the most common performance metric used in the hospitality industry. RevPAR combines both OCC and ADR to measure the room revenues generated by the hotel per room available for sale. It is considered as one of the most important metrics in the hotel industry.

However, the major concern for these commonly used Revenue Management metrics is that they have only considered the room division component. Guest room revenues may well account for nearly all of the revenue for a budget hotel but not for a luxury business/leisure/golf/casino hotel room (Ivanov, 2014). Room revenues for the latter may only be less than half of its total revenues, which points to a need for a more holistic measurement. Furthermore, as hotel companies become better at collecting and collating transaction data from all revenue streams, it is inevitable that the number of performance measures used by revenue managers will also grow (Walters, 2012).

4.1. Use of Revenue Management Metrics

Respondents were asked to indicate how they measure Revenue Management performance by offering them the following options: RevPAR, TRevPAR, GopPAR, Revenue generated index (RGI), and additionally the opportunity to list any other Revenue Management metrics in use.

The survey findings indicate that RevPAR (77.4%) is the most preferred way of measuring hotel revenue management performance, followed by RGI (48.5%), GopPAR (20.4%), and TRevPAR (13.7%).

Figure 5. Use of Revenue Management Metrics

Other types of performance measures may be categorized into three groups. The first group consists of Revenue Management measures other than the listed four (3.9%). Some of the measures are traditional OCC, ADR, average rate index (ARI), and market penetration index (MPI). Others are more contemporary measures, include NRevPAR, RevPASH, revenue per available treatment hour (RevPATH), revenue per square meter (RevPSQM), RevPAC, and profit per available room (ProfPAR).

The second group is based on accounting measures (4.3%) which consist of total revenue (Rev), earnings before interest, taxes, depreciation and amortization (EBITDA), gross operating profit (GOP), profit (PROF), and return on investment (ROI). These measures may be compared with the budgeted value.

The third group comprises non-Revenue measures (0.6%) such as customer satisfaction and quality score.

4.2. Limitations of Existing Revenue Management Metrics

In line with the discussion on the inadequacy of the existing Revenue Management metrics, respondents were asked to state the limitations if they perceive any.

With almost 65% of the respondents practicing either rooms and catering, rooms and catering with integrated marketing, or total revenue management optimization with integrated marketing as their revenue management culture, we would expect a greater proportion of the hotel respondents to find the existing revenue management metrics as inadequate. However, it is surprising to note a contradicting finding. The study shows that 66.1% of the respondents felt that the existing measures are sufficient for their need while 33.6% felt otherwise (see Figure 6).

Figure 6. Limitations of Existing Revenue Management Measures

Respondents who indicated the limitations of the existing Revenue Management metrics (33.6%) have expressed their view. Results of the text analysis reveal the limitations of the listed measures in five aspects (see Figure 7):

(a) lack of comprehensiveness,

(b) metrics not comparable,

(c) data accuracy,

(d) organizational constraints, and

(e) others.

Figure 7. Perceived Limitations of Revenue Management Measures

The primary limitation (53.2%) is related to the comprehensiveness of the Revenue Management measures since they generally do not include costs, profit, and the different sources of revenues.

The second limitation (21.7%) is associated with the accuracy of data. A small number of respondents (1.3%) doubted the authenticity of information provided by the hoteliers. However, there are more respondents concern about the ability of vendors to include all hotels and other types of accommodation property (e.g., Airbnb, vacation club) so that they could use the relevant comp set for benchmarking (2.5%). Other data accuracy problems include different reporting practices, timeliness of information, and inventory variation (3.5%).

The third aspect of limitation (10.1%) is associated with measures (e.g., TRevPAR, GopPAR) not being included in the current reports, for example STR reports. As a result, respondents could not make meaningful comparison against their competitors.

Finally, respondents commented that some of the measures are complex and demand appropriate technology, talented human resource, and knowledgeable decision makers which the organizations may be lacking (5.5%).

5.1. Knowledge of New Revenue Management Metrics

Given the limitations and ongoing complaints of the existing Revenue Management measures, it is expected that respondents are aware of alternatives, respectively new forms of measurements. As the study is interested in getting a holistic view on Revenue Management metrics, respondents were asked to indicate (several options possible) their awareness of the following new Revenue Management metrics.

Answer Option: NRevPAR (Net Revenue per available room),

Answer Option: RevPAC (Revenue per available customer),

Answer Option: RevPASH (Revenue per available seat hour), for use in Restaurant Revenue Management,

Answer Option: RevPATH (Revenue per available treatment hour), for use in Spa Revenue Management,

Answer Option: ConPAST (Contribution per available space time), for use in Function Space Revenue Management.

The above new Revenue Management metrics have been under discussion for some time (i.e. Mourier, 2012) although some (specifically NRevPAR and RevPAC) have yet to be conceptualized or applied in practice.

There are 36% of the respondents indicated their awareness of NRevPAR, 20% are aware of RevPAC, 18% are aware of RevPASH, 12% are aware of RevPATH, and 9% are aware of ConPAST (see Figure 8).

Furthermore, the respondents were asked to indicate other new Revenue Management metrics that they have knowledge of.

There are 3.6% respondents indicated their awareness of other measures, such as revenue per meter squared (RevPSQM), total revenue per occupied room (TRevPOR), and profit per available room (ProPAR).

Figure 8. Knowledge of New Revenue Management Metrics

At the first stage of this study, the authors had called for a focus group discussion. Two new Revenue Management metrics, NRevPAR and RevPAC, have been identified as most promising and needed for the future of metrics.

It is encouraging to note that about half (46.3%) of the respondents at the second stage of this study strongly indicated their willingness to adopt the new Revenue Management measures such as NRevPAR or RevPAC (see Figure 9).

Figure 9. Willingness to Adopt New Revenue Management Metrics

5.2.1. Positive Factors Affecting Adoption Intention

Respondents were given the opportunity to express their positive view towards the new metrics.

Perceived usefulness of the measures is the most significant factor (56.6%) affecting the adoption intention. These new metrics are regarded as valuable to drive channel optimization and total revenue management, increase efficiency and return on marketing efforts, improve planning and budgeting. Essentially, these advantages enable the hoteliers to develop effective strategies. It is also important to note that the usefulness of the measures is greatly associated with the data accuracy.

To some lesser importance, the support from company top management (1.5%) and the need to be in line with the industry practice (1.7%) are two other motivation factors (see Figure 10).

Figure 10. Positive and Negative Factors Affecting Adoption Intention

5.2.2. Negative Factors Affecting Adoption Intention

The respondents also have had the opportunity to elaborate their concerns about adopting the new Revenue Management metrics.

Text analysis on the respondents’ comments shows that the negative adoption intention can be attributed to four factors (see Figure 10 above). First, perceived lack of usefulness is the most influential negative factor (27.2%). Some respondents are contented with the current measures and thus do not perceive a need for the new ones at the present time (11.1%). On the other hand, others (16.1%) do not think the new measures provide relevant or additional benefits and insights nor applicable to the properties.

Second, respondents generally commented that they are not the decision maker. The adoption needed the top management to “buy in” the idea. In addition, there should be knowledgeable personnel and appropriate technology in place to implement the performance measures successfully. In short, the organizational constrain is important factor deterring the adoption intention (17.8%)

The third negative factor is related to the effort required to implement various Revenue Management metrics (8.9%). Respondents cited that the time and effort needed to implement the contemporary measures is substantial. This is further encumbered by the overwhelming work with the existing Revenue Management metrics.

Data accuracy and availability is the fourth negative factor (7.8%). Respondents commented that the relevant measures are not included in the supplier’s and vendor’s reports (i.e. STR etc.) currently. Hence, it is not available for comparison. Furthermore, respondents also distrust the data provided by hoteliers, especially when the reporting practices vary among companies.

5.2.3. Adoption Intention among Different Revenue Management Culture

The study also investigated the willingness to adopt new revenue management metrics among the four revenue management cultures. It is assumed that an organization with focus on Total Revenue Management needs new measures more than a business with room-focused revenue management culture. Hence, the adoption intention is expected to be higher for companies focusing on total revenue management than room-focused only.

Figure 11. New Metrics Adoption Intention by Revenue Management Culture

Results of the chi-square analysis show a significant association between adoption intention and the revenue management culture (c2(6) = 19.766, p = .003). Figure 11 above shows that the adoption intention is higher among the more complex revenue management cultures (room + catering + integrated marketing and total revenue optimization + integrated marketing).

Properties focusing on rooms only, on the contrary, are split between adopting and uncertain. Hence, the assertion that higher adoption intention for companies focusing on total revenue management than for room-focused only properties is supported.

In the previous question, respondents were requested to state their reasons for adopting or not adopting the new measures. However, to get the full picture and to seek clarity on the problems and challenges faced by the new measures, respondents were specifically asked if they would foresee any problems with the new Revenue Management metrics.

In line with the findings on willingness to adopt new metrics, 51.4% of the respondents do not foresee any problems with the new metrics while only 20.6% said otherwise (see Figure 12).

Figure 12. Problems Foreseen Using New Revenue Management Metrics

Results of the text analysis suggest four main areas of problems or challenges associated with the new metrics (Figure 13). Indeed, this question brought up a problem not revealed by the respondents in the previous question.

Figure 13. Perceived Problems Associated with New Measures

First, the new metrics pose resource challenges to organizations (28.7%). Many of the current systems are either insufficient to accommodate or incapable to incorporate the data needed for the new metrics. Furthermore, as the knowledge on this respect is generally limited, proper staff training and education on the new measures are needed.

Second, the data accuracy and availability (28.2%) has been consistently a concern for both the current and new measures. The absence of a standard reporting format has been repeatedly cited by the respondents. Data accuracy is further impeded by the difficulty to correctly distribute the cost involved and revenue generated within the hotel operations.

Third, respondents are concerned about the tradeoff between the time and effort invested and the additional benefits gained (19.1%). Not only are the data needed for accurate measurement complex, the substantial amount also curtails the ability of manager to process the information efficiently.

Finally, the respondents doubted the adoption rate by the industry practitioners (15.8%) since hoteliers are generally regarded as slow in adapting changes. The implementation of the new metrics will further be restricted without the initiative from the vendors.

Despite the perceived problems associated with the new metrics, the study also asked about the advantages of new Revenue Management metrics to uncover the relevance and focus of the usage.

Table 2 below exhibits the four primary advantages, namely driving channel optimization, planning and budgeting, efficiency and return on marketing efforts, and driving total revenue management, offered as answer options.

The ability to drive total revenue management is the leading advantage of the emerging measures. The advantages in driving channel optimization and planning and budgeting were ranked second and third, respectively. Efficiency and return on marketing effort trails behind.

Table 2. Advantages of New Revenue Management Metrics

| Advantages | Ranking | ||||

| 1 | 2 | 3 | 4 | 5 | |

| Driving channel optimization

|

172

(17.7%)

|

315

(32.4%)

|

270

(27.8%)

|

201

(20.7%)

|

13

(1.3%)

|

| Planning and budgeting

|

215

(22.1%)

|

265

(27.3%)

|

256

(26.4%)

|

226

(23.3%)

|

9

(0.9%)

|

| Efficiency and return on marketing effort

|

61

(6.3%)

|

199

(20.5%)

|

293

(30.2%)

|

402

(41.4%)

|

16

(1.6%)

|

| Driving total revenue management

|

499

(51.4%)

|

188

(19.4%)

|

142

(14.6%)

|

133

(13.7%)

|

9

(0.9%)

|

| Others

|

25

(2.6%)

|

5

(0.5%)

|

9

(0.9%)

|

8

(0.8%)

|

907

(93.4%)

|

Reading the table, the first order of ranking has been put in bold.

The value of Revenue Management measures is rather limited if used only internally. However, once shared with third parties such as STR and TravelClick, these companies provide processed and anonymised data for benchmarking.

In view of the importance and benefits of the measures, sharing data for competitive benchmarking purpose is paramount. The respondents were given the following three options:

Answer Option: Yes

Answer Option: No

Answer Option: NA

Result of the current study (Figure 14) is encouraging as more than half of the respondents (53.2%) indicated their willingness to share the data while the remaining are split between unwilling (25.2%) and uncertain = NA (21.7%).

Figure 14. Sharing of Data for Competitive Benchmarking

Industry contribution:

The Hospitality Sales & Marketing Association International (HSMAI) Asia Pacific Revenue Advisory Board contributed to framing the study, the study questions, the outcomes and results. This Advisory Board is made up of the heads of Revenue Management in hotel chains and management companies around Asia Pacific. More details on the Board can be found on our website at: https://hsmaiasia.org/revenue-advisory-board/

REPORT AUTHORS

Dr. Detlev Remy

Profile: https://www.singaporetech.edu.sg/directory/faculty/detlev-remy

LinkedIn: https://www.linkedin.com/in/dr-detlev-remy-65886315/

Prof Remy works as Associate Professor for the Singapore Institute of Technology, SIT, Singapore. He is teaching Revenue Management, Data Analytics and Digital Marketing whilst researching on Pricing and Revenue Management related topics. Prof Remy started his career in the hospitality & tourism industry in 1986, working in various positions up to general management position. Additionally he has started his own consultancy business, “Remy Consult”, advising international beverage, tourism and hospitality businesses, and providing executive education to a variety of stakeholders. Prof. Remy holds a Masters in Marketing from University College Cork, Ireland (2007), and a doctorate (DBA) from the University of Surrey, UK, (2014).

He holds membership of the ICHRIE, Irish Marketing Institute, the Chartered Institute of Marketing, UK, and HSMAI, acting as a Board member of HSMAI Revenue Management Advisory Board, APAC. Within his capacity as professor for various universities as well as owner of his consultancy firm “Remy Consult”, Prof. Remy conducts Executive Education training programs, especially in marketing-related areas, such as branding, pricing, revenue management, digital marketing and so on. Most recently, he has delivered Executive Education training programs to Singaporean hoteliers, a Cambodian hotel chain, Investors from Russia and Taiwanese hoteliers.

JOINT RESEARCH TEAM

Assistant Professor Tan, SIT

Seck TAN is an Assistant Professor at the Singapore Institute of Technology. He is an applied economist with broad research interests in policy analysis and policy recommendation towards sustainable development, evidence-based public policy formulation in relation to energy and environmental issues, as well as disruption impacts in the aviation and hospitality sectors.

His research focus is on environmental economics with reference to valuation of environmental goods and services, environmental accounting, and resource management applied to commodity-rich economies. He has been quoted and interviewed on mainstream media pertaining to climate change and weather issues.

Assistant Professor Boo, SIT

Huey Chern Boo is an Assistant Professor in Singapore Institute of Technology (SIT). She obtained her Master of Science and doctoral degree in Hospitality Management from Purdue University and Pennsylvania State University, respectively. She has vast experience working in hotels, foodservice establishments, and food manufacturing companies in the US, Canada, and Malaysia.

Dr. Boo had led several industrial projects with topics ranging from human resources (e.g., employee retention, employee training) to operations (i.e., queuing management, foodservice menu), and to marketing (i.e., dining decision, market segmentation). Her most current research projects are related to robotics and revenue management in the food and beverage industry.

Ms Shirley Tee, Nanyang Polytechnic (NYP)

Ms Shirley Tee is the Course Manager of the Diploma in Hospitality & Tourism Management at School of Business Management Nanyang Polytechnic with ten years of tourism and hospitality experience. She completed her Master of Management in Hospitality in 2008 from the esteemed Cornell University. She also holds a Bachelor of Business Administration (Honours) from National University of Singapore.

Prior to joining Nanyang Polytechnic, she was the MICE manager of Tradewinds Tours and Travel, the tour subsidiary of Singapore Airlines. In this role, she was in charge of both Singapore and overseas incentive travels and in the organisation of conferences and events. Some of the events she has been involved included the 117th IOC Session Spouse Programs 2005 and the S2006 IMF/World Bank Governors’ Meeting Delegates programs.

In addition, Ms Shirley Tee has held several positions during her term at Tradewinds Tours and Travel. This includes the position of Market Development Manager, whereby she supervised a team of tour planners for Europe, West Asia, North America, Southwest Pacific and South East Asia tour programs.

Mr. Stan Josephi, NHTV

Stan Josephi (1970) received his DBA from the Maastricht School of Management in 2015. Since 2005, he works as Senior Lecturer at the Academy of Hotel Management at Breda University of Applied Sciences.

Stan has extensive experience in the international hotel industry and his career in revenue management spans over 20 years, in which he has been involved with the phenomenon as a consultant, trainer, educator, and researcher. Stan’s research and expertise focus on the elements underlying the process of revenue management. He is particularly interested in studying the barriers that exist between the different commercial departments of hotel organizations, looking at (automated) solutions that will send organizations on their way to an integrated approach to demand management.

Stan is a member of the HSMAI Europe RM Advisory Board, and he is one of the founding members of the taskforce Revenue Profs. Furthermore, he is also a Member of the Board of Hotel Casa in Amsterdam.